Shawne Merriman's MMA Media Deal Signals New Paradigm in Latin American Fight Market

Sarah Johnson

December 5, 2025

Brief

An in-depth analysis of how Shawne Merriman's MMA promotion's ESPN media deal reveals strategic shifts in MMA's growth, focusing on Latin America’s rising market and fighter development dynamics.

Why Shawne Merriman’s Media Rights Deal Marks a Strategic Pivot in MMA’s Global Landscape

The recent multiyear media rights agreement between Shawne Merriman's Lights Out Xtreme Fighting (LXF) and ESPN for regional Latin American broadcasts underscores evolving dynamics in the mixed martial arts (MMA) industry. While the UFC remains the dominant global franchise, this deal highlights a strategic niche effort aimed at regional growth and talent incubation rather than direct competition.

The Bigger Picture: Wrestling with Legacy and Opportunity

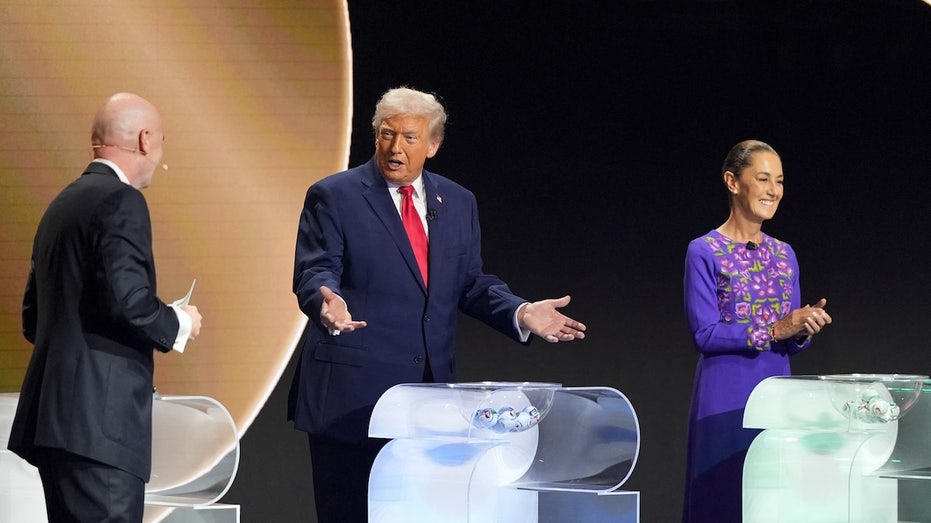

Shawne Merriman, a former NFL linebacker renowned for his aggressive playstyle, has transitioned effectively from traditional sports icon to MMA promoter. This pivot parallels broader trends where retired athletes are leveraging personal brands to enter the rapidly growing MMA market, valued globally at over $8 billion as of 2023. Yet unlike past efforts simply chasing UFC’s market share, Merriman’s approach is unique: he openly eschews competition with the UFC, instead focusing on creating a complementary ecosystem. Historically, regional MMA promotions—such as Bellator in the U.S. and ONE Championship in Asia—have found success by tailoring content to local fanbases and feeding fighters into larger leagues. Merriman’s deal with ESPN analogously targets passionate Latin American audiences, whose rich fighting traditions—from boxing legends to rising MMA stars—offer a fertile ground for growth.

What This Really Means: Aligning Media Strategy With MMA’s Latin American Resurgence

Latin America represents one of the fastest-growing markets for combat sports, with countries like Brazil, Mexico, and Argentina boasting deep-rooted martial arts cultures and increasingly sophisticated sports media infrastructure. ESPN’s multilingual broadcast rights—in English, Spanish, and Portuguese—signify a deliberate strategy to engage diverse linguistic groups spanning South America and the Caribbean. This approach reflects a recognition that globalization in sports is no longer one-size-fits-all but demands tailored regional content delivery.

By securing exclusive broadcasting rights for LXF events including the upcoming LXF 29, ESPN expands its combat sports portfolio beyond UFC and boxing. This diversification matters for media outlets facing competition from digital streaming platforms, as well as for advertisers seeking newer demographics. Merriman’s focus on nurturing fighters who eventually join the UFC positions LXF as an incubator rather than a rival, thereby carving out a vital space within MMA’s competitive ecosystem.

Expert Perspectives

Dr. Maria Gutierrez, a sports economist at the University of São Paulo, notes, "Merriman’s strategy recognizes that sustained growth in MMA depends on developing feeder leagues tailored to regional markets. Latin America’s passionate fanbase and sizable youth population present ideal conditions for this model."

James Holder, MMA analyst and author of The Fight Game: Global MMA Economics, explains, "Instead of spending heavily to disrupt the UFC, Lights Out Xtreme Fighting’s lean operational approach—with emphasis on data and technology—allows it to build value through efficiency and localized storytelling."

Data & Evidence: The Growing Appetite for Regional MMA Content

- A 2023 Nielsen Sports study found Latin American viewers represent 25% of global MMA audiences but receive less than 10% of English-language broadcast coverage.

- ESPN’s digital platforms have recorded viewership increases of 40% year-over-year for combat sports content in Latin America.

- Fighter origin data shows an upward trend, with Latin American athletes constituting approximately 15% of new UFC signings over the past five years.

Looking Ahead: A Model for Sustainable MMA Growth

If Lights Out Xtreme Fighting’s collaboration with ESPN proves successful, it could spur similar localized media deals in emerging MMA markets—India, Southeast Asia, and Africa among them. Merriman’s emphasis on technology integration and data analytics promises innovations in how fights are produced and fan engagement is measured. Moreover, by positioning LXF as a reliable talent incubator, it creates a symbiotic pipeline feeding fighters and content to the UFC, potentially stabilizing MMA’s fragmentation and preventing unsustainable bidding wars among promotions.

However, challenges remain, including cultivating consistent quality competitions and managing expectations about growth speed amid competition from entrenched entities like UFC and Bellator. Additionally, expanding digital reach while respecting diverse cultural contexts in Latin America will require careful programming and marketing agility.

The Bottom Line

Shawne Merriman’s Lights Out Xtreme Fighting deal with ESPN is not just a broadcast contract—it is a strategic blueprint for MMA’s next phase of globalization. By embracing a regional growth model that focuses on passionate Latin American audiences and positions LXF as a conduit to the UFC, Merriman moves beyond the zero-sum game of competition toward a collaborative, sustainable ecosystem. This approach respects the realities of MMA’s market dominance while unlocking important growth opportunities through smart media partnerships and talent development.

Topics

Editor's Comments

This media deal is illustrative of how modern sports properties must navigate global markets with precision and strategic partnerships rather than brute-force competition. Merriman’s candid acknowledgment that no promotion can realistically eclipse the UFC’s dominance shifts the narrative from conflict to collaboration. It raises important questions about how feeder leagues and regional promoters can sustain MMA’s growth ecosystem while ensuring diversity in athlete pathways and fan experiences. Observing whether LXF’s data-driven and localized strategy translates to long-term viability will be key. This also challenges other emerging sports ventures to reconsider aggressive market entry tactics in favor of thoughtful, regionalized growth models.

Like this article? Share it with your friends!

If you find this article interesting, feel free to share it with your friends!

Thank you for your support! Sharing is the greatest encouragement for us.